Not known Details About Guided Wealth Management

Not known Details About Guided Wealth Management

Blog Article

Not known Facts About Guided Wealth Management

Table of ContentsTop Guidelines Of Guided Wealth ManagementHow Guided Wealth Management can Save You Time, Stress, and Money.The Ultimate Guide To Guided Wealth ManagementHow Guided Wealth Management can Save You Time, Stress, and Money.All about Guided Wealth Management

For financial investments, make settlements payable to the product service provider (not your advisor). Giving a financial adviser full access to your account increases risk.If you're paying a continuous recommendations charge, your consultant ought to examine your monetary situation and meet you at the very least once a year. At this conference, ensure you review: any kind of modifications to your objectives, situation or financial resources (consisting of changes to your earnings, expenses or properties) whether the level of risk you fit with has transformed whether your current personal insurance policy cover is ideal just how you're tracking against your goals whether any kind of adjustments to legislations or financial items could impact you whether you've received everything they promised in your agreement with them whether you need any adjustments to your strategy Yearly a consultant should seek your written grant charge you recurring suggestions costs.

This may happen during the meeting or digitally. When you go into or renew the recurring cost setup with your adviser, they need to define just how to end your connection with them. If you're transferring to a new consultant, you'll require to organize to transfer your monetary documents to them. If you require aid, ask your advisor to explain the procedure.

Not known Details About Guided Wealth Management

As an entrepreneur or tiny company proprietor, you have a lot going on. There are several duties and expenditures in running a service and you absolutely do not need another unneeded costs to pay. You require to carefully think about the roi of any kind of solutions you obtain to ensure they are rewarding to you and your organization.

If you are just one of them, you may be taking a massive threat for the future of your organization and on your own. You may desire to keep reading for a list of reasons employing a financial consultant is helpful to you and your business. Running a company has plenty of challenges.

Cash mismanagement, capital troubles, delinquent repayments, tax obligation issues and various other monetary problems can be essential enough to close a service down. That's why it's so vital to regulate the financial aspects of your service. Employing a trustworthy economic expert can prevent your company from going under. There are numerous ways that a qualified financial consultant can be your partner in assisting your business grow.

They can deal with you in examining your monetary situation regularly to avoid major errors and to promptly correct any negative money choices. The majority of local business owners use lots of hats. It's reasonable that you wish to save cash by doing some tasks on your own, but dealing with finances takes expertise and training.

A Biased View of Guided Wealth Management

Planning A company strategy is vital to the success of your company. You need it to understand where you're going, how you're obtaining there, and what to do if there are bumps in the road. A great economic expert can assemble a thorough plan to aid you run your service a lot more efficiently and plan for anomalies that emerge.

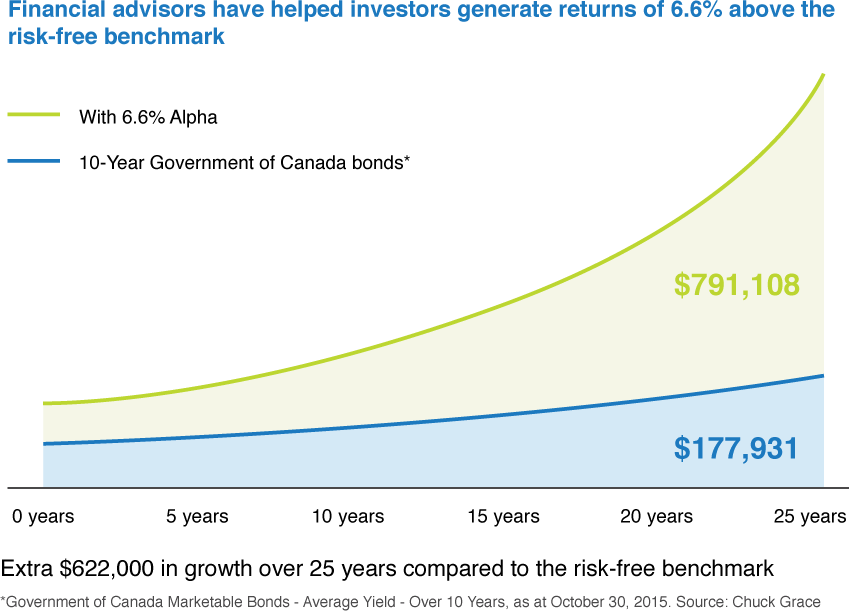

Wise investments are essential to accomplishing these goals. Most company owners either don't have the expertise or the time (or page both) to evaluate and assess financial investment chances. A respectable and knowledgeable financial expert can guide you on the investments that are best for your organization. Money Savings Although you'll be paying a financial expert, the lasting cost savings will certainly justify the price.

It's all about making the wisest financial decisions to enhance your chances of success. They can assist you towards the most effective possibilities to increase your revenues. Lowered Anxiety As a local business owner, you have lots of things to stress over (wealth management brisbane). An excellent economic advisor can bring you assurance knowing that your funds are obtaining the focus they need and your money is being spent intelligently.

4 Easy Facts About Guided Wealth Management Explained

Security and Growth A certified economic expert can give you clarity and assist you concentrate on taking your company in the ideal instructions. They have the tools and resources to utilize methods that will guarantee your organization grows and thrives. They can aid you evaluate your objectives and establish the finest course to reach them.

Guided Wealth Management Things To Know Before You Buy

At Nolan Audit Center, we give experience in all facets of monetary preparation for small companies. As a little organization ourselves, we understand the challenges you encounter each day. Give us a telephone call today to go over how we can assist your business thrive and be successful.

Independent possession of the technique Independent control of the AFSL; and Independent reimbursement, from the client only, using a set dollar fee. (https://hubpages.com/@guidedwealthm)

There are numerous benefits of an economic organizer, despite your circumstance. But despite this it's not uncommon for individuals to 2nd guess their suitability due to their setting or present financial investments. The goal of this blog site is to prove why everybody can gain from a monetary plan. Some common problems you may have felt on your own consist of: Whilst it is simple to see why individuals may assume in this manner, it is certainly not right to deem them correct.

Report this page